Before you start using Bento for Business, you should know that it has certain limitations. These limits may hinder your business growth. For example, you cannot spend more than $25,000 per day. As such, if you need to spend more than that, you should not use Bento for Business. Alternatively, you could try using a different meal delivery service. Here are some of your options:

Wire transfers through Bento

To initiate a wire transfer through Bento, you must first verify that you have a bank account through which to send money. Then you must enter the verification deposit amounts. Once you have verified your bank account, you can initiate your Bento transfer. After your transfer has been completed, you will be notified via email that the funds have been transferred successfully. If you are unsure whether or not the wire transfer has been successful, you can check your bank statement to ensure that it was processed successfully.

For security purposes, Bento requires that you provide a verified email account and user ID for any Authorized Signers. Failure to provide the right information could lead to your transaction being declined. In addition, your Billing Address must be accurate. Otherwise, you may be unable to send funds from your business account. By using the correct billing information, you will ensure the safety of your business funds. After all, it is your money!

Account limits of Bento

For your account to be active, you must first authorize Bento to transfer funds from your bank account. Then you must provide specific account information, such as your Account Number and Account Reference, to Bento. Your bank will initiate the wire transfer and funds should be available within one business day. Note that bank holidays can delay wire transfers. Account limits may vary depending on your business and the type of transaction you are making. To avoid exceeding these limits, keep your account information up to date.

Despite its low monthly fee, Bento for business has account limits. These limits can make it impossible to grow your business beyond the limits. In addition, the service does not support spending limits higher than $25,000 per day. So you need to keep this in mind if you plan to use Bento for business. Listed below are Bento for business account limits for your employees. While they may seem reasonable, they could hinder your business’ growth.

Free trial

If you want to try Bento for business, you can take advantage of a free trial. You can get 60-days of free service if you sign up for the plan. During the free trial period, you can use a coupon to begin your trial. The coupon code is available online and can be shared on social media or in emails. You can also comment in the comment box to let other people know what you think about the service.

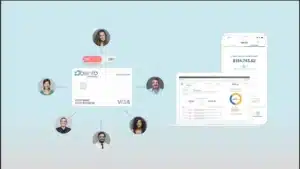

Bento for business offers a credit card alternative that empowers businesses to track employee spending. It allows businesses to set spending limits, decline non-qualified transactions, and switch off cards quickly and easily. Bento also provides prepaid MasterCard debit cards without the need for background checks or credit score impact. To try the free trial of Bento for business, sign up now and get started using the service today. You can download the app here and try it free for 30 days.

Billing information

If you have a remote workforce, you may want to consider a service like Bento for Business. The company’s Bento Cards let remote employees purchase items without the need for a company check or paper check. Billing information for Bento for Business has straightforward – all you need is your business’ basic information and you’ll on your way to earning your employees’ trust. Bento’s digital payments platform eliminates the need to print checks and paper checks and lets employees keep working. Moreover, it saves you money, because it’s based on a bank account, and has secured by FDIC.

The Bento for Business Visa debit card comes with no annual fees or credit-check requirements. All you have to do is choose the number of cards you need from the various packages, and deposit the amount you want into your account. Your money has fully insured up to $250,000 by the FDIC. Once you’re done, simply go to Bento’s website to learn how much you owe. If you’re not sure which amount to deposit, you can contact Bento’s customer support team for further guidance.

Admin permissions

If you have more than one employee in your business, Bento allows you to add additional admins. Admins have specific permissions to manage aspects of your Bento account. For example, you can assign certain employees with the roles of Assistant, Bookkeeper, or Accountant. Admins can also issue Bento cards at no additional cost. By granting admins specific permissions, Bento offers you full control over the way your employees use your funds.

Bento for Business has a powerful B2B payment solution, providing small and midsized businesses with unprecedented control over their expense management. Using the platform to manage payments, businesses can avoid fraud and misuse while saving hours of administration every week. In fact, according to a recent study, 33% of businesses have suffered from expense reimbursement fraud or misuse by employees. As a result, businesses spend an average of 20 hours tracking expenses each week, in order to remain compliant with regulations.

Getting More Information

Here Is How To Move Forward In Your Life

Zupoo Really Work and Safe & Effective

Summer Hats- Past And Present for You

Top Four Ways in Which Powder Brows Can Give You Natural Beauty

Definition and Tips for High Local Ranking

Interesting Facts About Cleo Buckman Schwamm

How to Choose the Right One for You